loose leaf books of accounts deadline

Application Requirements Deadline and Renewal. BIR Form 1701 or 1702 and Audited Financial Statements.

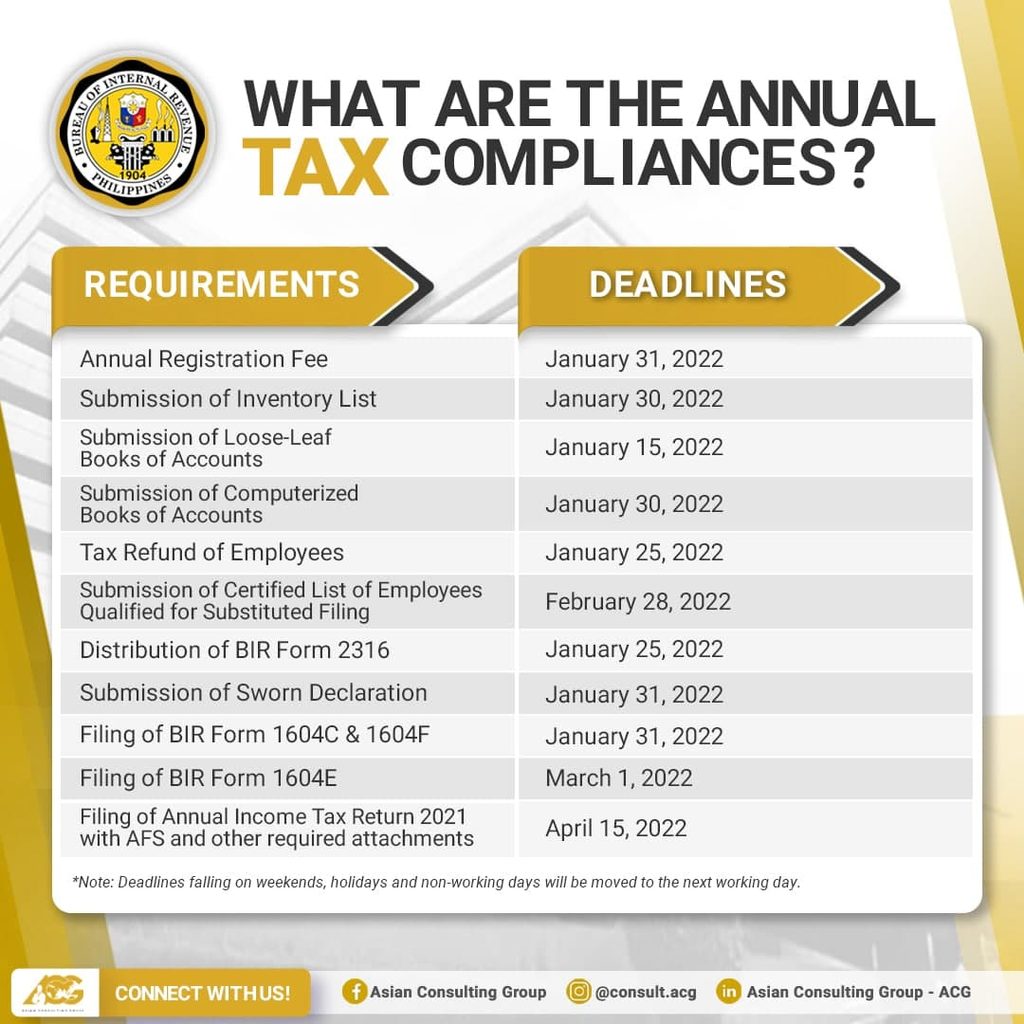

Loose Leaf Books Of Accounts Annual Submission

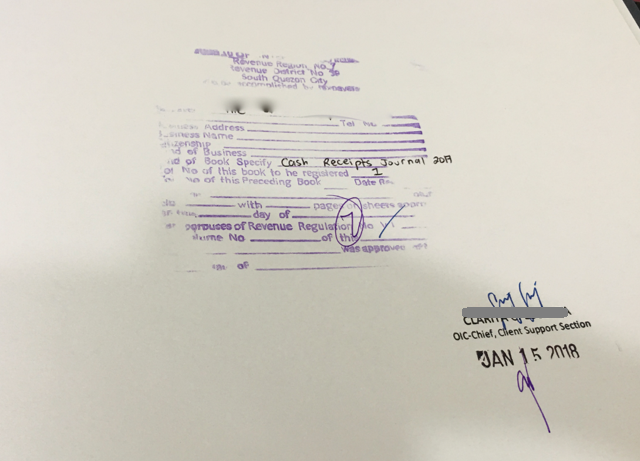

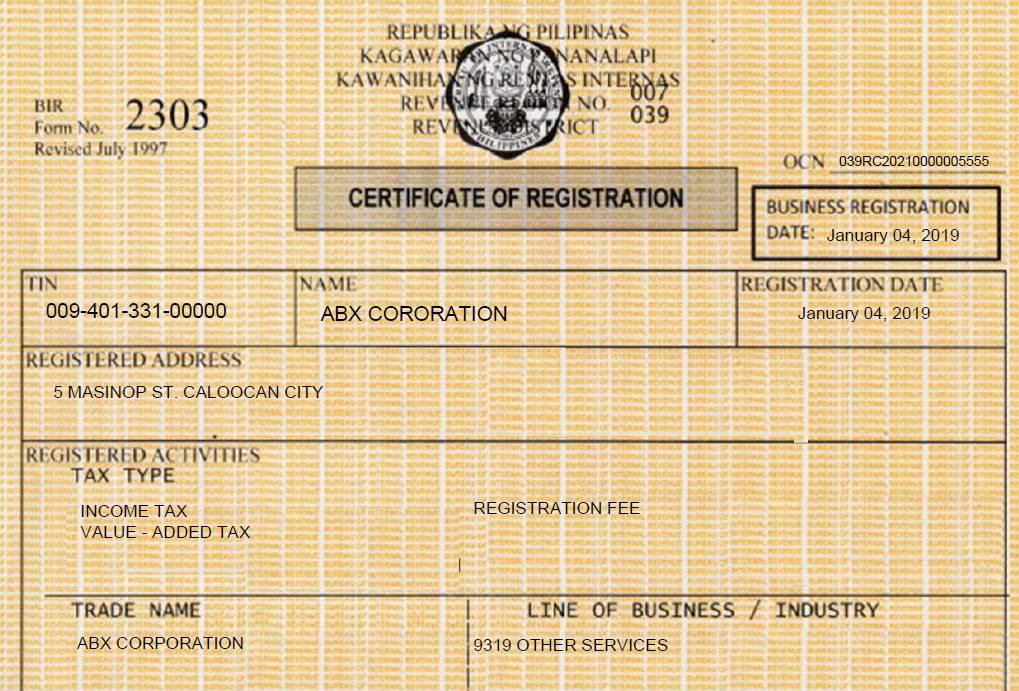

Upon registration of Loose-leaf books of accounts the following are required.

. Lastly there is a stiff timeline to finalize your records and do all the other requirements before the BIR deadline for. According to Revenue Memorandum Circular. First there is an additional cost to print and cost to book-bind the loose leaf books.

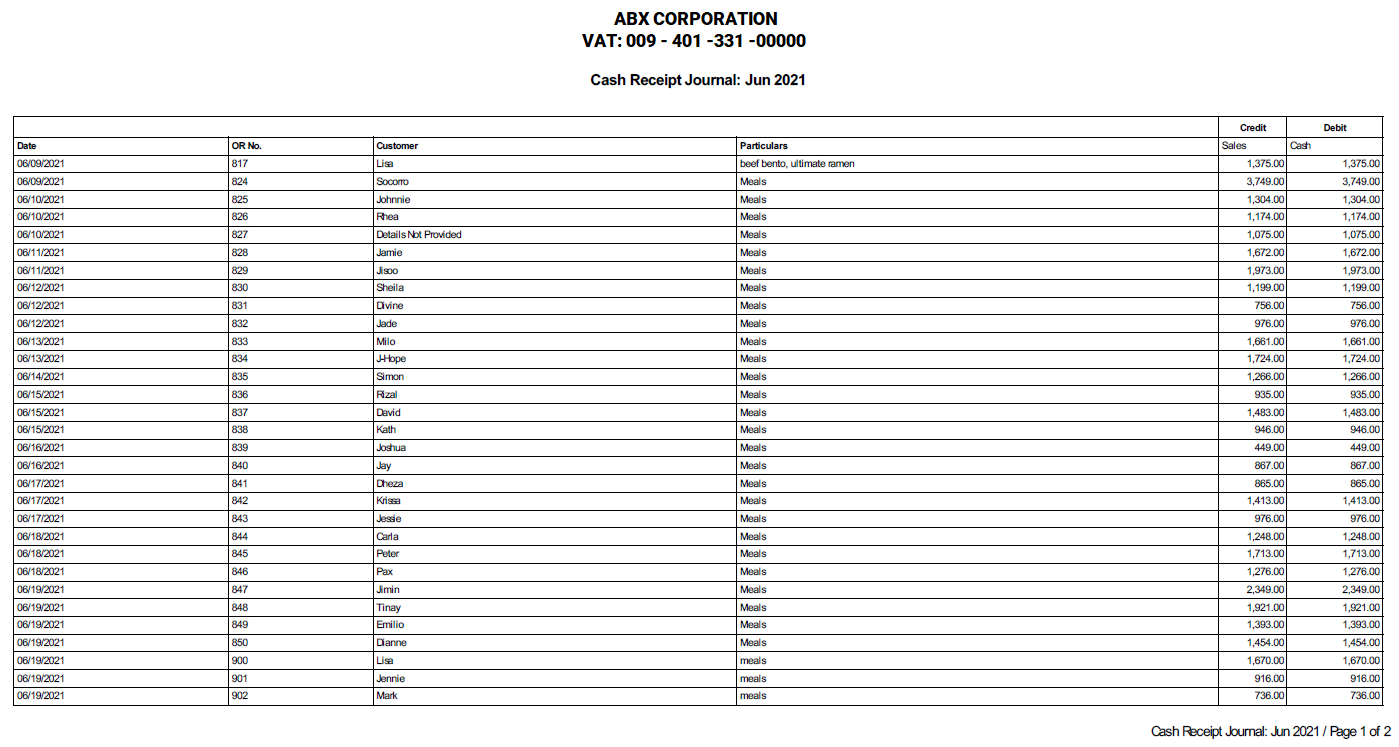

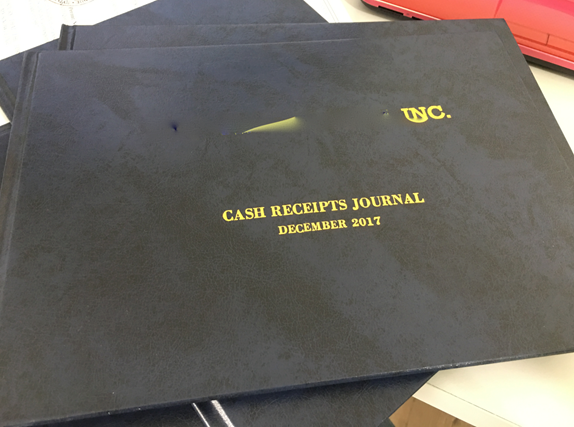

Criminal Investigative Function - A Guide for New Investigators - 3rd Edition by. Loose-Leaf Books of Accounts. Any business that maintains its accounting books via the loose-leaf books of accounts system is required to submit BIR approved accounting.

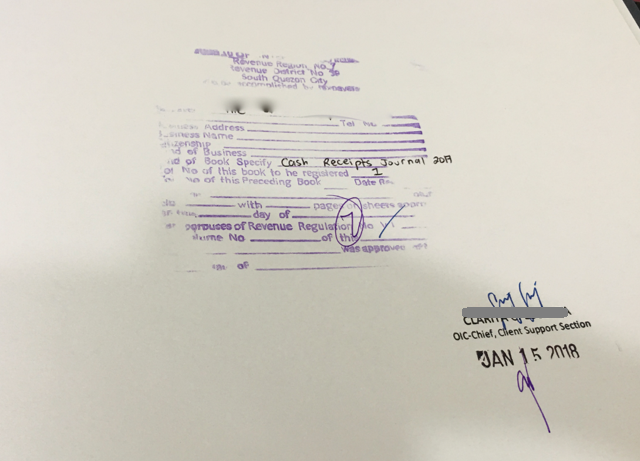

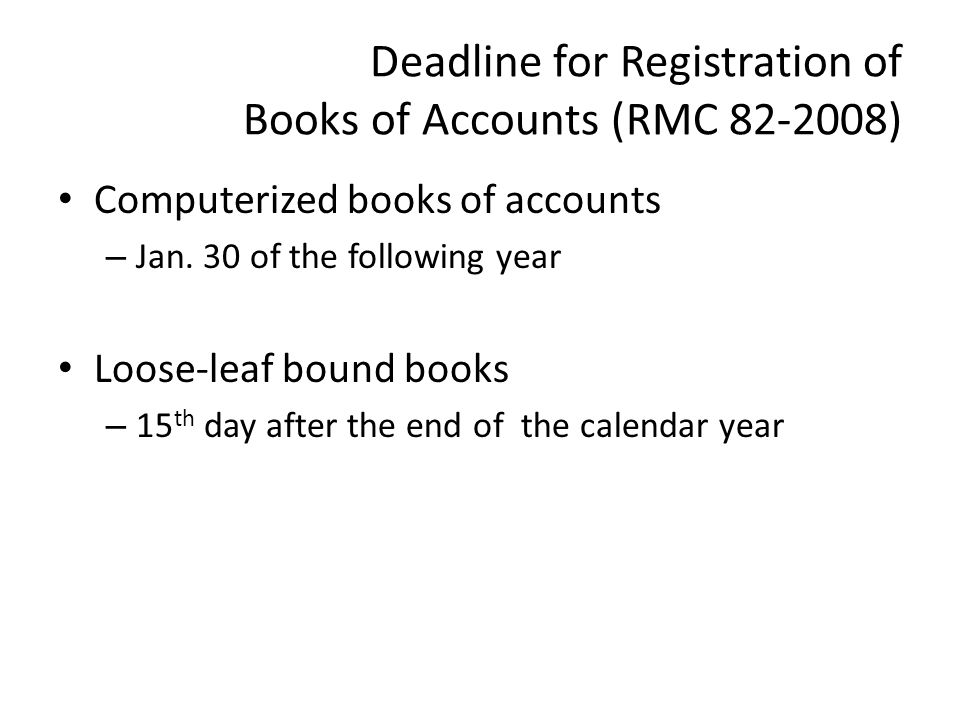

A Submit duly accomplished BIR Form 1905 at the RDO or concerned office under the Large Taxpayer Service having jurisdiction over the place where the head office and branch. Digest Full Text. Second you need to submit the loose leaf books annually to the BIR RDO on or before January 15 of the following calendar year.

There has been a bit of confusion on where the application for the PTU of loose leaf books of. Accounting System or Components thereof Loose - Leaf Books of Accounts Description This form is to be accomplished by all taxpayers who intend to apply for. 1 manual Books of Accounts.

Taxpayers may maintain theirits Books of Account in any of the following manner. Updated guidelines on PTU loose-leaf filing Revenue Memorandum Circular No. Giacalone 4495 Softcover 7 x 10 398 pages 978-1-60885-179-9 978-1-60885-179-9.

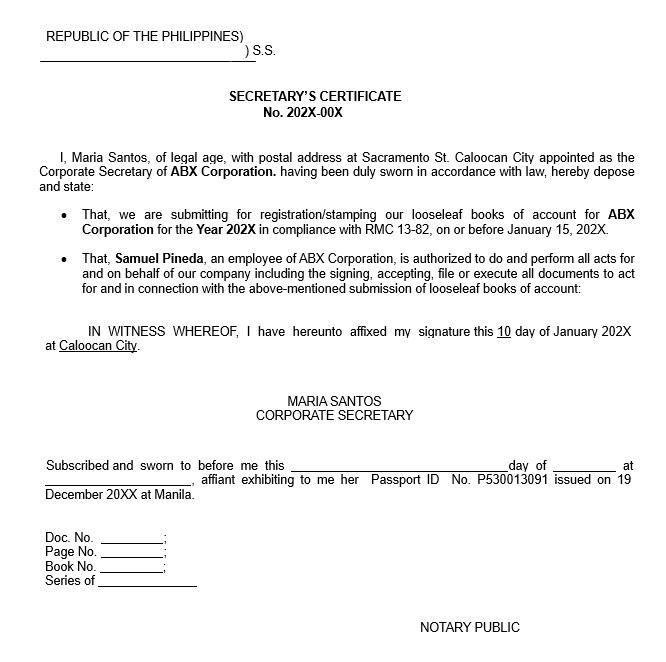

Loose-leaf Books of Accounts are still considered manual so there is no need to have a formal accounting system. The application for the Permit To Use Loose-Leaf Books of Accounts will require at a minimum the following documents. Tax Alert 25.

If I apply for a Permit to Use PTU in the middle of the year when do I start recording transactions using the Loose-leaf Books of Accounts. BIR Form1900 in duplicate original Sample format and print-out template which the company intends to use. Loose-leaf books of accounts and Computerized books of accounts.

However a taxpayer has an option to renew their registration quarterly which is due every 20th. 2 loose leaf Books of Accounts with Permit to Use. Follow this guide so you can say goodbye.

You can damage or. Ad Browse discover thousands of brands. BIR Form 1900 is the called the Application for Authority to Use Computerized Accounting System or Components thereof Loose-Leaf Books of Accounts This form must be filled out.

Permit to Use Loose Leaf Books of Accounts. To apply for BIR Loose Leaf a company must initially apply for a Permit to Use PTU Loose-leaf books of accounts with the BIR. 68-2017 August 10 2017 This Tax Alert is issued to inform all concerned on the new venue.

An Ultimate Guide to Loose Leaf Books of Accounts. The Commissioner of Internal Revenue has issued Revenue Memorandum Circular RMC No. You will need to print bind and submit your books of accounts that are generated from your spreadsheets or.

Deadline for manual filers. Read customer reviews find best sellers. 68-2017 dated 10 August 2017 the Circular to clarify the.

For loose-leaf books of account the taxpayer shall maintain encoded details of the accounting records in the computer and shall generate copies in print using the duly approved. However theres an option to pay the renewal registrations quarterly which is due 20 days after the close of the. Registration of permanently bound computer-generatedloose leaf books of accounts and.

Switching to loose-leaf books of accounts. Deadline of Annual Payment of Business Registrations Renewal is January 20. Meantime cloud based accounting users can use loose leaf books of accounts.

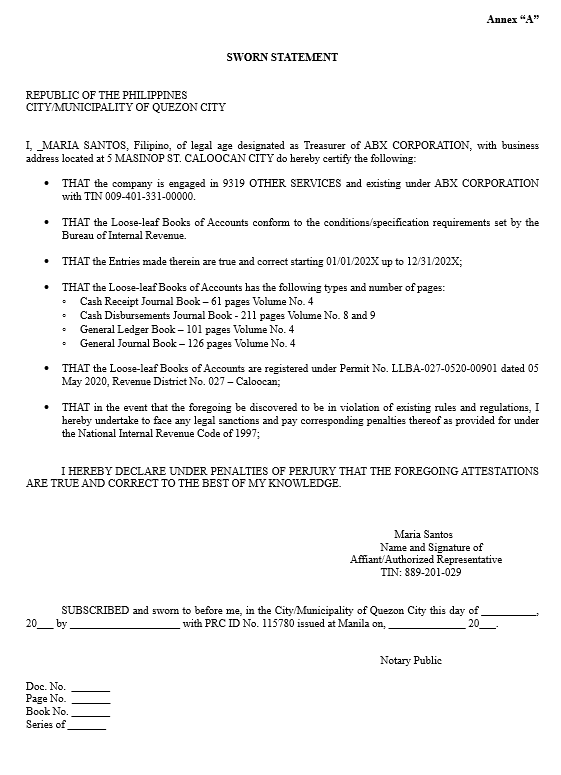

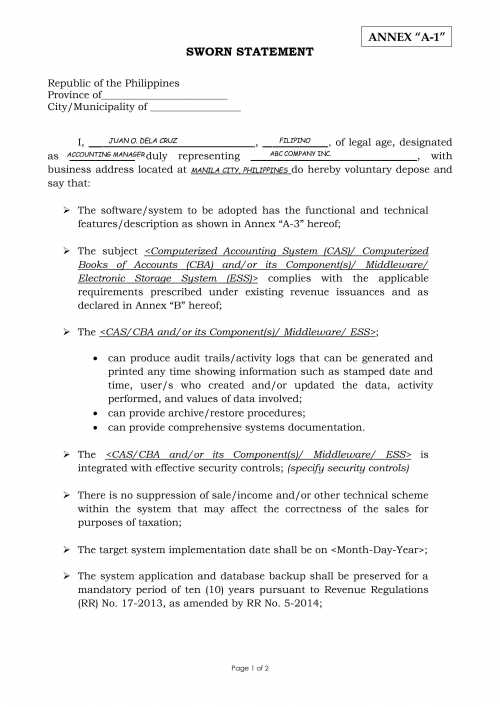

Affidavit attesting the completeness accuracy and correctness of entries in Books of Accounts and the number of. Loose-leaf Books of Accounts. Payment Form Annual Registration.

The deadline for annual payment of business registration renewal is every 20th of January. Registration of computerized books of accounts and other accounting records together with affidavit attesting the completeness of the computerized. Only the manner of recording has been adopted to electronic mode.

Online shopping from a great selection at Books Store. Many a la Carte editions cannot be sold back since they do not have their own ISBN or there is low demand for used loose leaf books in general. Sworn Statement of the company specifying the type of books that will be used and submitted.

The memorandum circular is dated February 22 2019 which re-emphasized the manner of keeping of books of accounts the deadline for the registration of the books the examination of.

Loose Leaf Books Of Accounts 2022 Filing

How To Apply For Bir Loose Leaf Qne Software Philippines Inc

Loose Leaf Books Of Accounts Annual Submission

Insider Tip Preparing Your Books Of Accounts For Business Permit Renewal Audit Fullsuite

Masyadong Bang Marami Ang Transactions Mo Monthly At Halos Sa Maubos Na Ang Oras Mo Sa Pag Bobookkeeping Manually Every Month Apply Na For Loose Leaf Bookkeeping Check Here The Steps On How

Permit To Use Loose Leaf Books Of Accounts Mpcamaso Associates

Loose Leaf Books Of Accounts Annual Submission

Loose Leaf Books Of Accounts Annual Submission

Ask The Tax Whiz What Are The Year End Requirements For Taxpayers

What You Need To Know About Books Of Accounts Beyond D Numbers Consulting Co

Permit To Use Loose Leaf Books Of Accounts Reliabooks

New Rules On Keeping Maintaining And Registering Books Of Accounts Cpa Davao Accounting Tax Business

Loose Leaf Books Of Accounts Annual Submission

How To Apply For Bir Loose Leaf Qne Software Philippines Inc

Loose Leaf Books Of Accounts Annual Submission

Formats Of Books Of Accounts Explained

Updated Guidelines On Ptu Loose Leaf Filing Grant Thornton

Bureau Of Internal Revenue Revenue District Office No 113 Davao City Ppt Video Online Download